Does Late Credit Payment Automatically Register As Late

If you lot take belatedly payments on your credit report, your credit score is likely suffering considering of information technology. The health of your credit is largely dependent upon your payment history.

There are several different approaches you tin can have to accost whatever existing late payments on your credit reports and get them removed.

Only showtime, detect out exactly how they impact your credit and then you can begin repairing your credit history. And then you lot can pick the most effective method for late payment removal.

How practice late payments impact your credit score?

Having just i late payment on your credit report can be devastating to your credit scores.

Whether it's a late car payment, credit menu payment, or mortgage payment, a recent late payment tin can crusade equally much as a ninety-110 betoken drib in your FICO score.

Every bit time goes on, the tardily payment will hurt your credit score less and less until it drops off your credit study. Still, potential creditors tin nevertheless see that payment history equally long as it's listed on your credit report.

Late payments appear on your credit report as either 30 days late, sixty days late, ninety days tardily, or 120-plus days late. Each of these degrees of delinquency has a different affect on your credit scores.

The later you are, the more harm information technology does to your credit history. More recent tardily payments on your credit study as well take a greater impact than older ones.

How many days late earlier information technology is reported to the credit bureau?

Creditors may report a belatedly payment to the credit bureaus once it hits 30 days past the due date. However, some creditors may non report it at all, especially if you lot've mostly been a good customer.

Others may expect until yous close your business relationship to report them. In one case yous are 90 days late or more, it affects your credit fifty-fifty more.

At this betoken, it tin be turned into a charge-off if the creditor decides to sell the outstanding balance to a collection bureau. However, even if you are already xc-plus days late on a payment, it's nonetheless a good idea to pay to avoid additional harm in the form of a accuse-off, collection, or repossession.

No matter how much you owe, late payments accept the same effect. To the credit reporting agencies, a late payment of $50 is just as bad every bit one of $v,000. Knowing this, if you accept to choose which bills to pay first, it may exist wise to pay the less expensive ones first.

How long do late payments stay on your credit report?

Late payments remain on your credit report for upwards to seven years. Still, reverse to pop belief, you do NOT accept to wait up to vii years earlier being able to get a mortgage, car loan, or whatever other type of credit again.

Your credit score volition steadily rise equally time goes on. Fifty-fifty improve is that in that location are several ways to get the late payment permanently deleted.

Continue reading to find out how y'all tin go a tardily payment removed from your credit reports.

How to Remove Late Payments from Your Credit Report

Late payments can exist deleted or updated to "never tardily" on your credit written report. Information technology's really quite piece of cake if you do it correctly, and you tin choose from a few unlike options.

The method you lot should select depends on your general credit history, your human relationship with the creditor, and the amount of time or coin you're willing to put towards these efforts.

Hither is an overview of 4 ways you can successfully remove a late payment from your credit written report.

i. Request a Goodwill Aligning

This is an ideal selection if you generally have a good payment history with your creditor and have been a customer for a while.

By requesting a goodwill adjustment, yous can ask the creditor to remove the belatedly payment from your credit reports equally a gesture of goodwill since you've otherwise been a groovy customer.

To do this, write a goodwill letter to the credit card issuer or lender and explain your situation. Credit card companies have some flexibility when information technology comes to reporting belatedly payments. They can remove late payments from your credit report under the right circumstances.

Did you have an unexpected expense arise final month that made you lot late? Are you trying to perfect your credit score so yous tin get a mortgage or an automobile loan?

Include your personal story in the goodwill letter so that the customer service representative reading your letter of the alphabet understands why this would be helpful.

Many people succeed with this method because creditors don't want to risk losing your account considering of a unmarried disagreement.

2. Offering to Sign Upward for Automated Payments

In some instances, a creditor may agree to delete a late payment from your credit reports if you agree to sign upward for automatic payments.

This plan works well if you've had trouble making payments in the past but aren't significantly delinquent on your account. You'll have meliorate luck negotiating this deal if y'all tin show that you're financially able to make your payments.

It besides helps if you've overcome whatever financial hurdle held you lot back from making payments in the past. Like requesting a goodwill adjustment, this is also ideal for longer-term customers.

3. Dispute the Belatedly Payment

If the first ii options aren't successfully getting your late payment removed, it'due south time to file a credit dispute directly with credit bureaus. The Fair Credit Reporting Act (FCRA) allows you lot to do this if you observe any inaccurate information regarding the belatedly payment on your credit study. Creditors must verify the information and remove inaccurate information from your credit report within 30 days.

To begin the dispute process, you will commencement demand to request your credit study. The FCRA allows you lot the right to at least ane free credit report every 12 months from each of the three major credit bureaus.

Check your credit report to ensure that the appointment, payment amount, and other details are correct. If anything seems off, send a dispute letter to each of the three credit bureaus reporting the late payment.

You should get a response from the credit bureau about your dispute within xxx business days, which is required past law. This is a good choice if you accept the fourth dimension and inclination to research and execute an effective dispute.

4. Work with a Professional

If you're not confident in your ability to successfully dispute a late payment on your own, there are several pop credit repair companies that can help you.

Credit repair firms have knowledgeable legal professionals on staff to help you out. They also help with other negative information on your credit reports.

It's easy to call for a free consultation to get an idea of the cost and the services they'll provide you with. Working with a pro is a not bad idea if you're brusk on time, unsure of your own abilities in disputing, and accept some buffer room in your budget for this short-term expense.

How can a professional credit repair visitor help me?

Check out this story from ane of our readers to meet how professionals helped them.

Getting my credit back on rail

Several years ago, I went through some tough times financially. I had always made on-time payments, but after I became unemployed, I simply wasn't able to pay my bills on time.

Afterwards I told a friend of mine about my problems, he suggested I check out Lexington Law. So, I chosen them for a free consultation at 800-220-0084. I spoke to a credit professional who told me they believed they could help me.

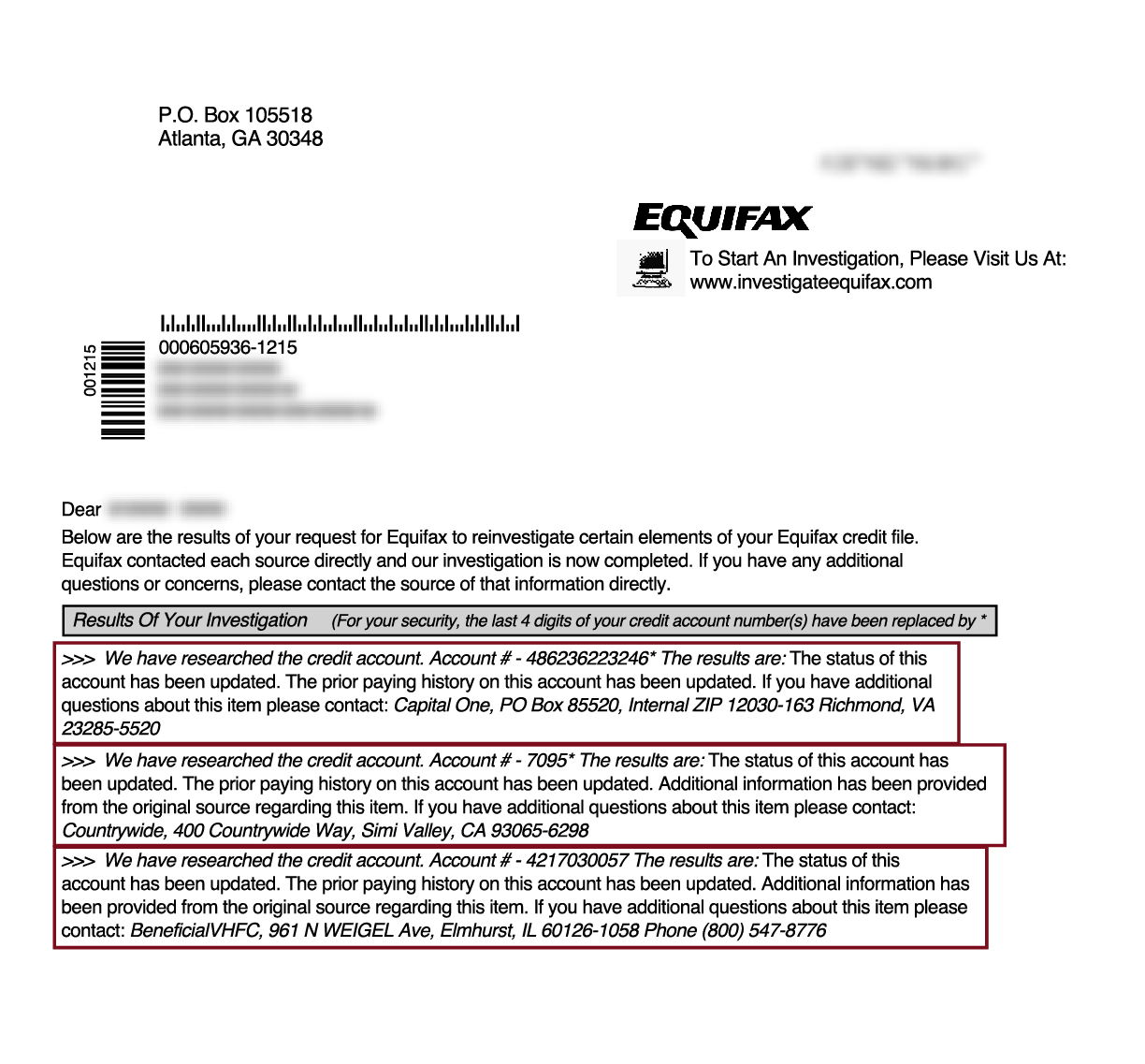

I decided to sign up and give it a shot. Later all, if information technology didn't work, I could abolish at whatever time. Then, after only a few weeks, I started getting letters from consumer reporting agencies showing negative credit accounts were removed from my credit reports.

Since so, my FICO credit score has been improving steadily, and I have been getting much meliorate interest rates on credit cards and loans. So it turned out to be a great decision for me (meet below).

Client Testimonials:

— C.R., Lexington clientI but wanted to thank you and tell you that your system is going to exist able to put me in a dwelling house well-nigh 2 years before than I originally expected to.

My credit score has jumped over sixty points in the last 6 months to a very respectable level and now when I utilise for a mortgage. I will be able to name my cost. And then file this e-mail in the happy customer department. I will refer anyone with less than perfect credit to your services it has fabricated a world of difference for me! Thanks again!

— H.M., Lexington clientI can see that your method really works. I appreciate all that you have done for me so far. Already, I was able to walk into a machine dealership, get approved in a matter of minutes, and qualify for a tier 1 rating. I haven't been tier one in years!

I also want you lot to know that I have recommended your services to many of my friends, family, acquaintances and business assembly. No matter how conscientious or diligent you are, you tin can all the same stop up with blemishes on your credit. I'1000 glad that you lot guys are out at that place to assistance remove them.

Discount for Family Members, Couples, and Active Military!

Lexington Law is now offering $50 off the initial set-upward fee when yous and your spouse or family unit members sign up together. The one-fourth dimension $l.00 discount volition be automatically applied to both you and your spouse's first payment.

Agile military members also authorize for a i-time $50 discount off the initial fee.

Prepare to Get Started?

Lexington Law successfully disputed and removed over 9 million negative accounts in 2018; over 1.2 million of them were late payments.

They tin delete all kinds of negative items from your credit reports, including bankruptcies, foreclosures, repossessions, charge offs, judgments, tax liens, collections, late payments, and more than.

If you're sick of having bad credit, let the professionals take care of information technology for yous.

Call one (800) 220-0084 for a gratuitous consultation and a free credit score. You'll be glad you did!

Does Late Credit Payment Automatically Register As Late,

Source: https://www.crediful.com/how-to-remove-late-payments-from-credit-report/

Posted by: schoenrockbety1981.blogspot.com

0 Response to "Does Late Credit Payment Automatically Register As Late"

Post a Comment